About Insolvency Practitioner

Table of ContentsInsolvency Practitioner for DummiesThe Basic Principles Of Insolvency Practitioner A Biased View of Insolvency PractitionerThe 4-Minute Rule for Insolvency PractitionerHow Insolvency Practitioner can Save You Time, Stress, and Money.

As long as the payments are kept regularly, typically there is no demand to review the arrangement. Your bankruptcy expert might suggest different voluntary financial obligation arrangements that might be a better alternative for bankrupt business, such as a Company Volunteer Arrangement (CVA). A CVA is an excellent option to trying to prepare an informal agreement with your financial institutions.Since it is a legitimately binding contract, and as long as the proposal has actually been concurred by all the lenders, the firm can proceed to trade. The bankruptcy specialist remains to oversee the CVA, which is generally for a regard to 3 to 5 years, up until it concerns an end.

Quiting an ending up petition hazard. Bringing money owed to creditors right into one month-to-month payment to the supervisor, the bankruptcy specialist. Prices much less than administration or a Plan of Arrangement. Will certainly boost cash flow and permit the company to continue to trade. The initial work is to make certain that the bankruptcy specialist near you is qualified and belongs to among the Recognised Professional Bodies (RPBs) in the UK, which are: Insolvency Practitioners Association Institute of Chartered Accountants of England and Wales Institute of Chartered Accountants in Scotland Institute of Chartered Accountants in Ireland Only licensed insolvency experts are permitted to act in insolvent business and personal bankruptcy proceedings, including serving as a liquidator, a manager or a supervisor of a CVA.

The Best Strategy To Use For Insolvency Practitioner

Constantly ask about their fees. Whilst many IPs will certainly provide the initial appointment on a no obligation, absolutely free basis, they will charge for their continuous solutions. They ought to constantly be able to provide you with a quote of the costs entailed however remember, picking the most inexpensive choice is not always the ideal program of activity.

Key facets that will certainly help you pick the best IP (Insolvency Practitioner)for you, your firm and your conditions include: the far better the communication between you, your IP and your creditors, the extra successful the result. The IP needs to be able to properly and clearly converse with firm supervisors, stakeholders, financial institutions and officials

Gaining the trust of all celebrations involved is key to agreeing the ideal volunteer arrangement.

What Does Insolvency Practitioner Do?

If your organization is battling with financial obligations or you are assuming of ending up a solvent business voluntarily, the primary step is to seek professional advice. Our extremely knowledgeable experts at are on hand to help and suggest on the process.

Insolvency practitioners encourage directors on their obligations and duties, aiding them avoid activities that could lead to individual obligation. Bankruptcy practitioners manage the entire process successfully, from preliminary assessment to final resolution.

This boosted confidence can assist in much better negotiations and assistance from creditors. Bankruptcy professionals play a vital role in aiding services browse economic crises. Their proficiency, neutrality, and strategic strategy offer invaluable support, guaranteeing conformity, optimizing asset value, and checking out rescue choices. Involving insolvency experts not only mitigates dangers and responsibilities however additionally raises the possibilities of organization recovery and connection, inevitably benefiting all stakeholders entailed.

An insolvency specialist visit homepage is one of the most visit site usual terms you are most likely to see. If you have fallen on hard times, an insolvency practitioner can give you with the aid you need.

Some Ideas on Insolvency Practitioner You Should Know

They can act freelance, yet they will certainly typically help a larger firm. If the bankruptcy specialists you assign are not accredited, they do not come from a governing body and have actually not confirmed they have the necessary abilities to deal efficiently with your funds. If a specialist does not belong to a governing body, they will not be able to perform specific tasks, and also they will certainly likewise not be court designated.

You will require to pay these lendings back using the money that your company eventually makes. You will certainly additionally have numerous other obligations you require to resolve and remain on top of. If there ever comes to be a point where the cash your service is making is not nearly enough to keep on top of your obligations, you will certainly end up being bankrupt.

If you do not appoint your own practitioners, after that they will be appointed for you by the Court. An insolvency professional has two major roles.

Some Known Facts About Insolvency Practitioner.

In doing this, they will need to show 2 primary objectives in mind. These are to determine all the different properties presently held by the insolvent navigate to this website business, and the second is to exercise whether the insolvent business has actually taken part in any kind of type of transgression, be it all at once or a single person.

People have been messing up money or investing business money on individual possessions here. Insolvency Practitioner. If this takes place, that person might be fined and outlawed from running a firm in the future. When executing their tasks, a lot of bankruptcy specialists will adopt a pragmatic approach to make sure that one of the most cost-efficient solution is located throughout the process

Kel Mitchell Then & Now!

Kel Mitchell Then & Now! Michelle Pfeiffer Then & Now!

Michelle Pfeiffer Then & Now! Amanda Bearse Then & Now!

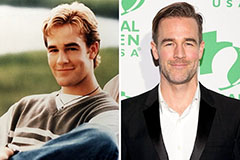

Amanda Bearse Then & Now! James Van Der Beek Then & Now!

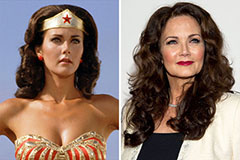

James Van Der Beek Then & Now! Lynda Carter Then & Now!

Lynda Carter Then & Now!